Table of Contents

- Fed Rate Cut Expectations 2024 Pdf - Peggi Chelsie

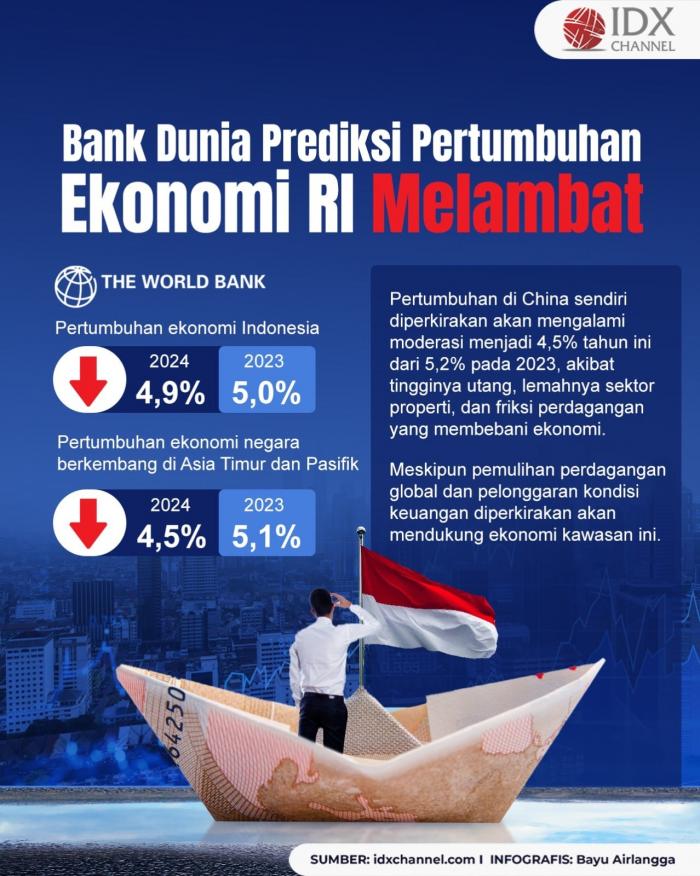

- Bank Dunia Prediksi Pertumbuhan Ekonomi RI Melambat Jadi 4,9 Persen ...

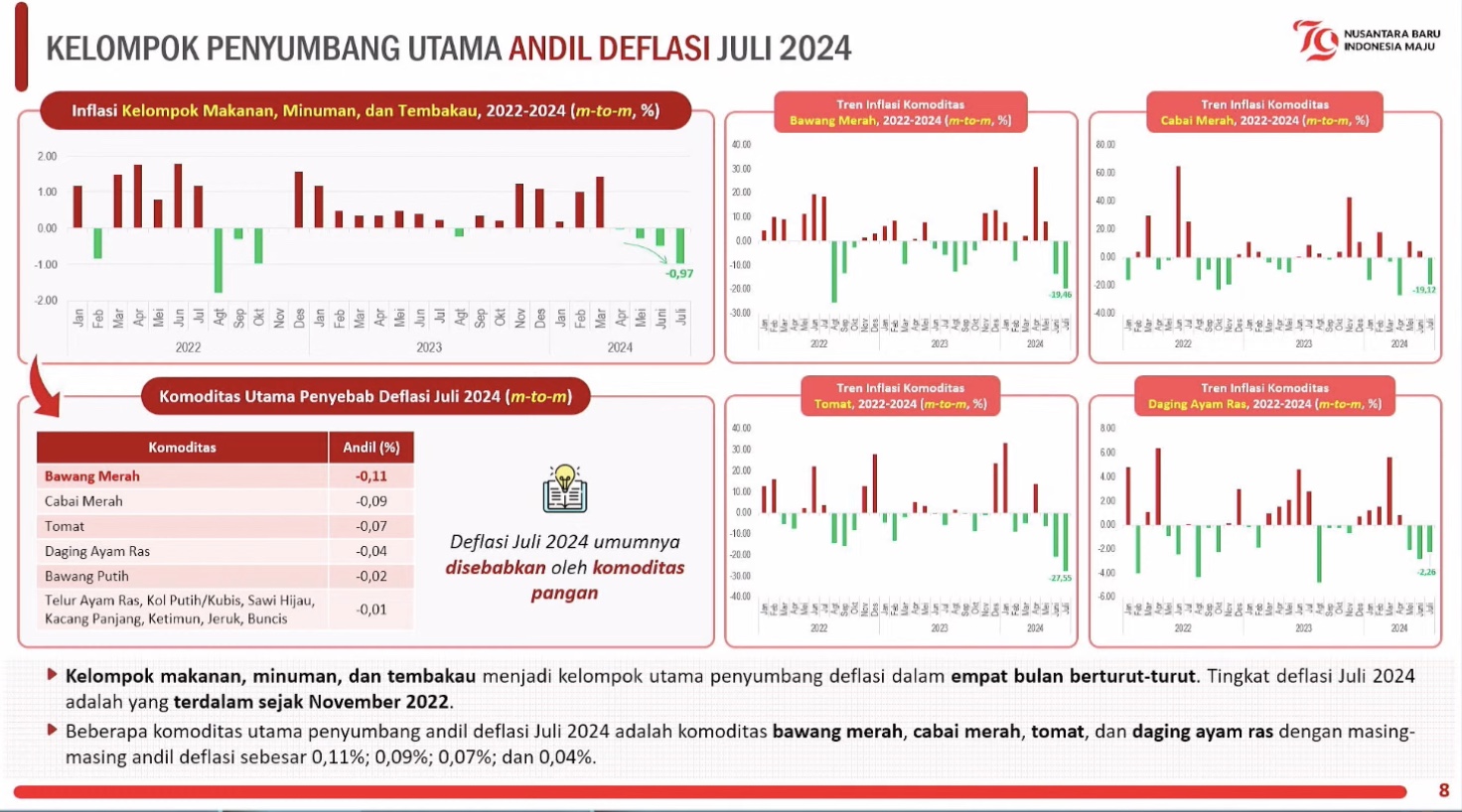

- Indonesia Deflasi 0,18 Persen Juli 2024, Makanan hingga Tembakau jadi ...

- Fed Rate Cut News 2024 Today News - Kelsy Mellisa

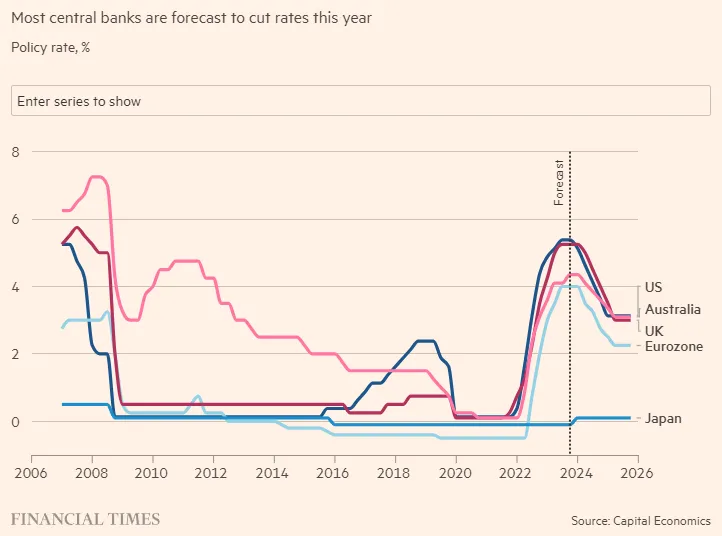

- Fed rate cuts to remain in view for 2024, even as rate-setters shift ...

- Fed prepares to shift to rate cuts in 2024 as inflation eases

- BPS: Ekonomi RI deflasi 0,12 persen pada September 2024 - ANTARA News

- Bank Indonesia Optimistis Inflasi 2024 Terkendali - Bisnis Tempo.co

- Kemenkeu proyeksikan inflasi global 5,2 persen pada 2024 - ANTARA News

- Fed Rate Increase 2024 - Peria Madelene

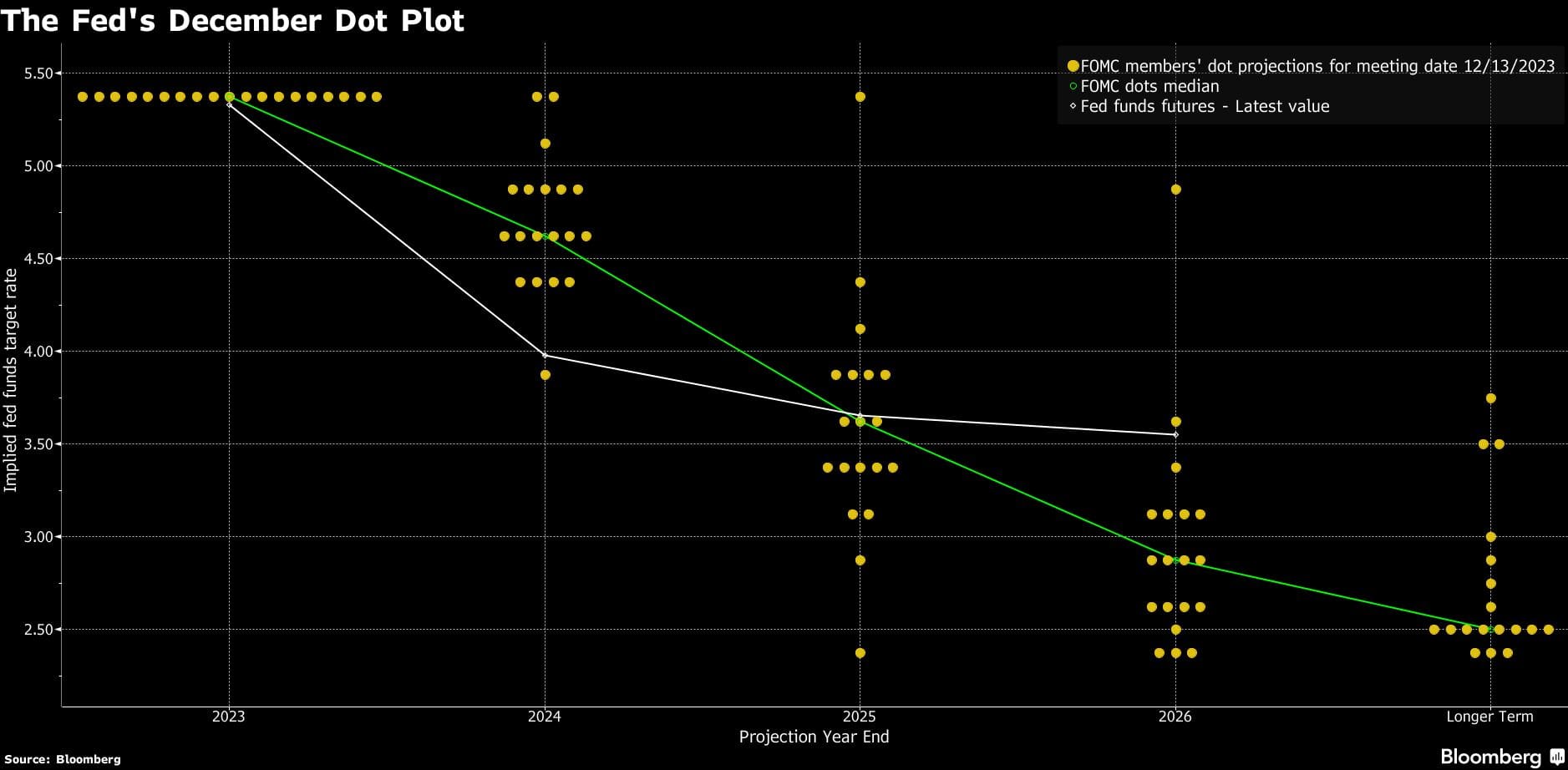

The Fed's decision to stand pat on interest rates is largely attributed to the ongoing economic expansion, which, although slowing, still shows signs of resilience. The labor market remains strong, with unemployment rates at historic lows, and inflation, while ticking up, is still within the Fed's target range. These factors have led the Fed to adopt a cautious stance, opting not to rock the boat with premature rate adjustments. Instead, the focus is on monitoring economic data and being prepared to act if necessary.

Forecasting Rate Cuts in 2024

The forecast of rate cuts also reflects the Fed's commitment to maintaining maximum employment and price stability. If the economy were to slow more than anticipated, rate cuts could help stimulate growth, prevent a sharp increase in unemployment, and keep inflation from falling below the Fed's 2% target. This proactive approach underscores the Fed's role in navigating the economy through challenging times.

Implications for the Economy and Investors

- Cheaper Borrowing: Reduced interest rates make borrowing more affordable for consumers and businesses, which can boost spending and investment.

- Stock Market Impact: Rate cuts are often seen as positive for the stock market, as cheaper money can lead to higher stock prices and increased economic activity.

- Housing Market Boost: Lower interest rates can make mortgages more affordable, potentially leading to an increase in housing market activity.

- Dollar Value: Interest rate cuts could lead to a decrease in the value of the dollar, making exports cheaper and potentially boosting the manufacturing sector.

However, it's crucial to note that the actual implementation of these rate cuts depends on how the economy evolves. The Fed will continue to monitor economic indicators closely and adjust its forecasts accordingly. The path to 2024 is filled with uncertainties, including the outcome of the presidential election, the trajectory of global trade policies, and the resilience of the labor market.

The Federal Reserve's decision to hold interest rates steady, coupled with its forecast of potential rate cuts in 2024, reflects a cautious yet proactive approach to monetary policy. As the economic landscape continues to evolve, the Fed's actions will be closely watched by investors, policymakers, and consumers. The future of interest rates will depend on a complex interplay of domestic and international factors, making the Fed's job of balancing economic growth with price stability more challenging than ever. As we move into 2024, one thing is clear: the path of interest rates will be a key story to follow, with potential implications for economic growth, financial markets, and everyday life.